~by State Senator Jesse Green

January 7, 2022

Greetings and Happy New Year!

Another session has arrived! This has been my first off-season experience since being elected. Having the extra free time the off-season provides to meet with groups and get a feel for what the needs of the district are has been rewarding and beneficial. Generally, election years are quieter at the Capitol. This year, I anticipate the environment will be somewhat different due to the various circumstances facing the state. We are seeing great opportunities, but also challenges that lawmakers must pay close attention to before we gavel out. I believe this session will be marked by three common themes: unemployment reform, tax reform, and education.

Unemployment reform should be a bipartisan issue. When a person drives throughout any part of Iowa, the help wanted signs are distributed in high numbers. Businesses are being forced to make tough choices due to this problem. We must do everything possible to get people who are available and able to work back into the workforce. I believe one of the topics that will be focused on to help address this issue will be to start with indexing how many weeks one can apply for unemployment benefits to the unemployment rate. We have had a standard 26 weeks for how long one can apply for benefits for decades. With an indexing system during a time of low unemployment and high number of jobs being available, the amount of weeks one can apply for unemployment benefits would be more limited. An indexing system during times of high unemployment and low job availability, the number of weeks would be expanded. There have been other states that have experimented with an indexing concept, and it has shown positive results. The money that indexing has saved in combination with getting folks back to work has put those states in a much stronger fiscal position. The other workforce topics that will be discussed will be on topics such as increasing the work search requirements as well as eliminating non-compete work clauses for low wage earners.

Tax reform will be front and center this year. We currently have over a billion dollars in surplus. Most of us believe that the best way to invest this overpayment for government services is to reinvest this money to the taxpayer in the form of tax relief. We have made significant progress by lowering the income tax rate as well as getting rid of the inheritance tax for example, but we need to keep chipping away at the income tax. In order to compete with states such as South Dakota and Florida, this strategy must be front and center until the income tax is gone!

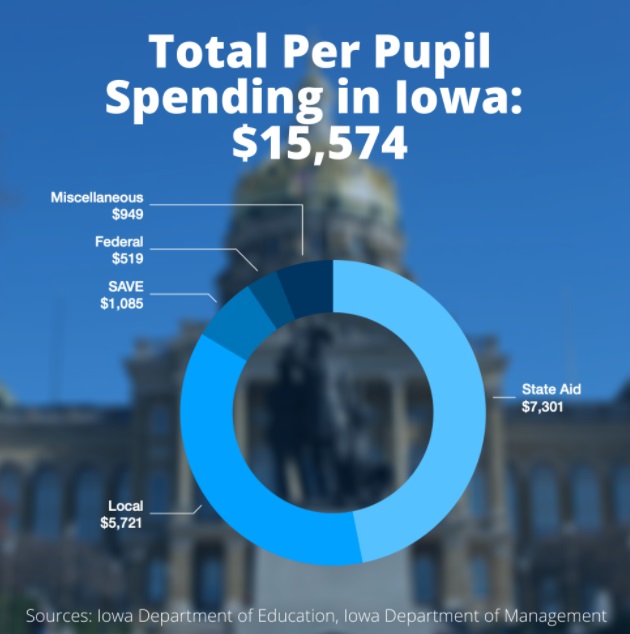

Education again will be another hot topic. Regardless of party, education is our state’s number one priority and the importance of education is reflected in our budget. Most people do not realize that the real taxpayer investment in education is over $15,000 per student. When we put together the numbers last year, the total spending per pupil was $15,574. The state’s portion of this pie is about $7,300. The rest of the pie consists of federal and local dollars. Over half of our budget is invested in education. I am grateful that due to consistent and sound budgeting, the state has been able to give consistent increases to this priority.

As a result of the pandemic, more parents are finding other sources of education. Is the most responsible response from the state to invest dollars into those private environments as well? In my mind, yes! I can’t make this statement any more simple than this: the greater the choice in education, the greater the accountability in education, the easier it is to have these sensitive conversations. I hope that the conversation about funding will also be tied to the topic choice. If these two parts of the conversation are linked together, then I believe this session will finish smoothly and most people will be happy with the results.

One of the benefits of entering into my second year is that I now will be more comfortable in running legislation. This off-season, I have been meeting with constituents and getting bill ideas. Bills I will be personally filing will range from having more accountability for drivers to show proof of insurance, getting rid of the date requirements to bale road ditch hay, and a bill that covers the topic of tattoos.

Yes, you heard me correctly, a Christian conservative farmer will introduce a tattoo bill! This bill is designed to help cut regulation that hampers the ability for tattoo business to handle food and drink. For example, there will be a large tattoo convention that will be taking place this year in Des Moines. Due to current rules, tattoo establishments cannot serve, consume, or sell food and drink at these events. I hope to help this convention out so they can have a more successful conference, but also expand this help to all tattoo businesses.

As always please feel free to reach out to me about any issue you are facing. The most rewarding experience in public service is talking with constituents about their thoughts and helping them navigate the complex environment of government so they can find potential solutions to issues hampering their day to day lives. Thank you again for giving me this opportunity to serve you.

Happy trails!